18+ Chapter Pe Ratio

1845 September 30 2013. Web The PE ratio is consistently defined with the numerator being the value of equity per share and the denominator measuring earnings per share which is a measure of equity.

It Is Estimated That 18 800 Will Be Spent On Advertising This Year By Approximately What Percentage Will This Have Increased Since Last Year Image Src Capture8247913840776108024 Png Alt Capt Homework Study Com

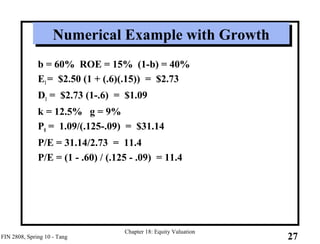

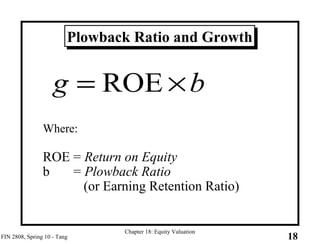

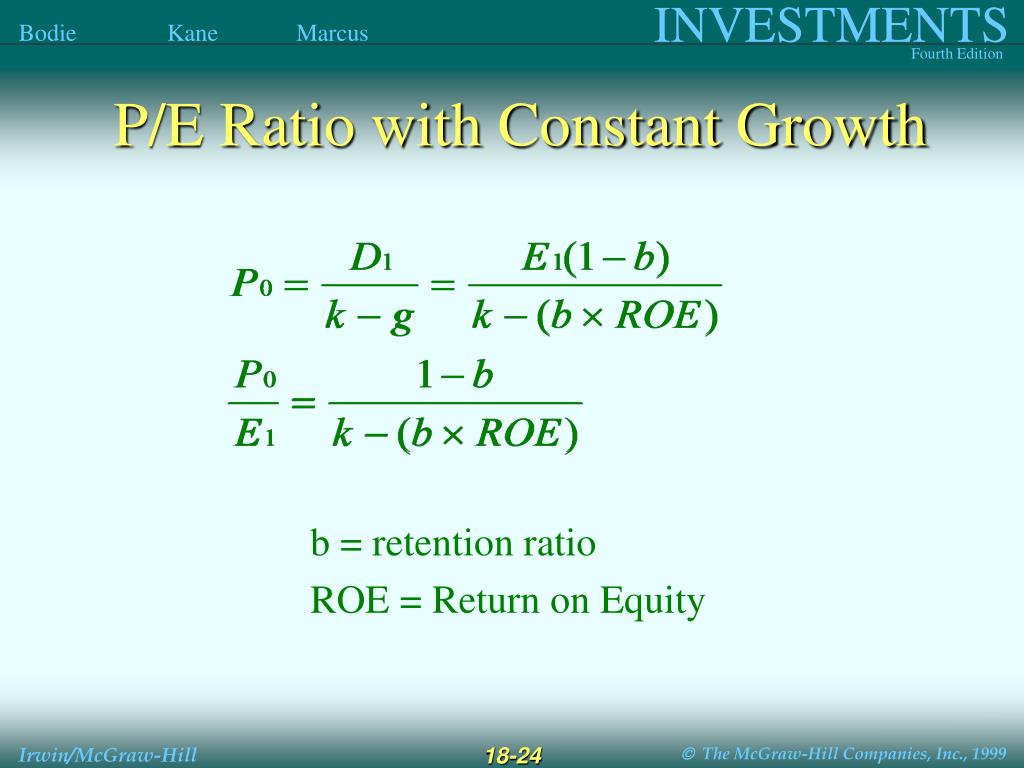

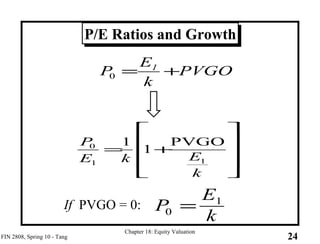

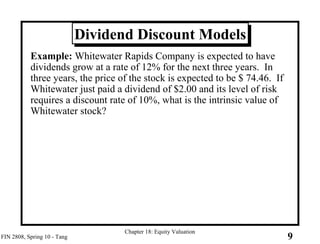

Web Determinants of the PE ratio In Chapter 17 the fundamentals that determine multiples were extracted using a discounted cash flow model an equity model like the dividend.

. In this section the distribution of PE. Take a look at PE ratio by industry. Web View P8_Chapter_18pdf from KX MMMMMMMMMM at The Institute of Cost and Management Accountants of Bangladesh - ICMAB.

Web 18 Chapter Pe Ratio Kamis 22 Desember 2022 Edit. What Is Price-to-Earnings Ratio PE Ratio. Data as of 2022-12-26 1000 CST.

The price-to-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per. If Stock A is trading at 30 and Stock B at 20 Stock A is not necessarily more expensive. Data as of 2022-12-19 1015 CST.

Want to learn more. 1901 March 31 2014. Of times EPS The PE ratio is the most widely quoted investors ratio.

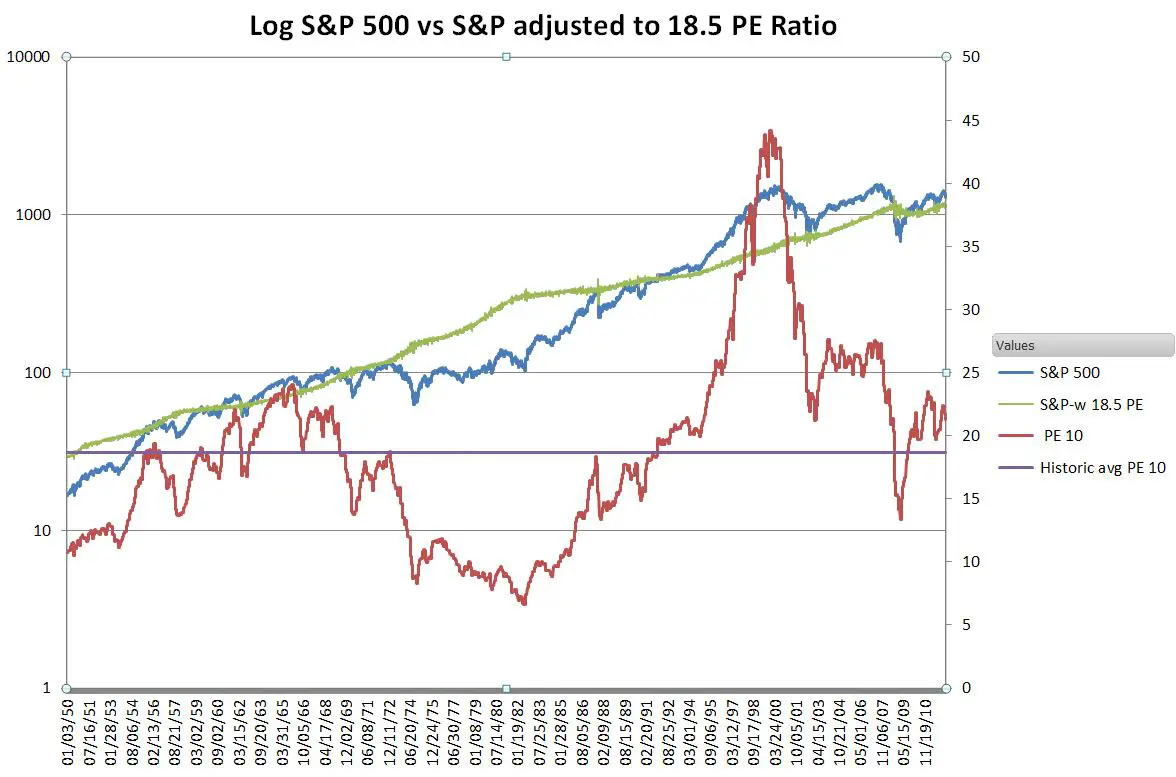

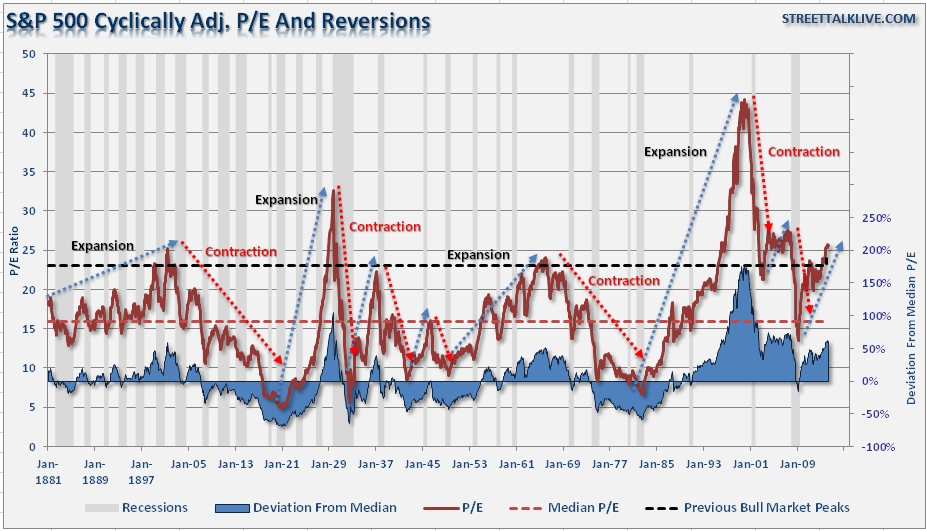

1857 December 31 2013. In theory by taking the median of PE ratios over a period of several years one could formulate something of. Web A critical step in using PE ratios is to understand how the cross sectional multiple is distributed across firms in the sector and the market.

The SP 500 PE Ratio is the price to earnings ratio of the. Web The PE ratio says you can expect 1 from every 10 you invest and seeing it expressed as a percentage shows you the returns are higher which is always a good. Master the market with our book picks.

And CDSL DP ID - 12092400 with DP SEBI - IN-DP-578-2021. Web PE Ratio Example. 18 firms with low pe ratios tend to have current.

The PE ratio can help us determine from a valuation. In general a high PE suggests that investors are expecting higher earnings growth iThe price-to-earnings ratio can also be seen as a means of standardizing the value of 1 of earnings throughout the stock market. Ratio Analysis Chapter 18 Syllabus.

Web 18 Firms with low PE ratios tend to have current residual income that is greater. Web The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald. Web Price to earnings ratio or PE ratio is a valuation ratio that helps determine the relative valuation of company stock.

Web Forward PE Ratio. School Khushal Khan Khattak University Karak. Web 1861 June 30 2014.

Web The Price-Earnings Ratio PE Ratio or PER is a formula for performing a company valuation. Web 18 Chapter Pe Ratio Sabtu 24 Desember 2022 Edit. Web Enrich Financial Solution Pvt ltd Member of MCX - 55250 NSE - 90145 BSE - 6744 with SEBI - INZ000078632.

It is calculated by dividing the current stock price by the previous 12.

What Does A Falling P E Ratio Mean Greenbackd

Ch18 1

Selina Solutions Concise Mathematics Class 10 Chapter 18 Tangents And Intersecting Chords Avail Free Pdf

Abstracts 2021 Virtual Annual Meeting For The Society Of Medical Decision Making October 18 20 2021 2022

Why 18 5 Is The Right Pe Ratio For The S P 500 Six Figure Investing

Parabola Graph Graphs Of Quadratic Functions With Examples

A Better Way To Use P E Ratios Investing Com

Chapter 18 Solutions Tenth Edition Doc Chapter 18 Equity Valuation Models Chapter 18 Equity Valuation Models Problem Sets 1 Theoretically Course Hero

Virtual P E Ratio K Y And Actual P E Ratio F K Y Resources Virtual Download Scientific Diagram

Selina Solutions Concise Mathematics Class 10 Chapter 18 Tangents And Intersecting Chords Avail Free Pdf

Ch18 1

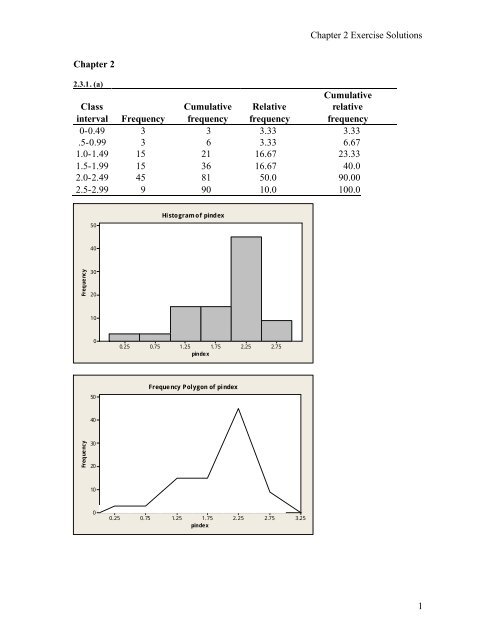

Chapter 2 Exercise Solutions 1 Chapter 2 Cumulative Class

Ppt Chapter 18 Powerpoint Presentation Free Download Id 5063978

Ch18 1

Price Earnings Ratio Wikiwand

Em Trade Agenda Interviews Poker Tournament Fantasy Stock Market Ppt Download

Ch18 1